Welcome to our third post where we discuss how organisations can use the TCFD (Taskforce on Climate related Financial Disclosures) framework to identify and assess climate related-risks and opportunities and importantly show the financial impact of risks to the business.

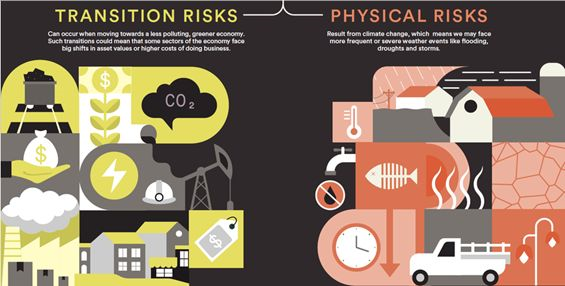

Climate-related risks can be divided into two broad sectors; risks related to the physical impacts of climate change (e.g., extreme weather events and rise of sea level) and risks related to the transition to a lower-carbon economy (e.g. changing market demand and carbon pricing). Let us go into a little more detail:

Physical risks are those related to weather related headlines that we now see on the regular basis such as floods, heatwaves and wildfires to name just a few. These physical risks can be further divided into two categories – acute and chronic risks. The former relates to event driven impacts and the latter relating to longer term shifts in climate patterns. These have the potential to affect anything from the organisation’s supply chain to employees’ safety.

Transitional risks include shifts in market, technology, policy and litigation, effect on reputation etc.

The benefits from TCFD disclosure, include increased awareness and understanding of climate-related risks and opportunities within the company, resulting in better risk management and more informed strategic planning. We know we live in a time of increasing risk; a better understanding of these risks could enable decision-makers to navigate a more sustainable and indeed prosperous future.

In our next post we will look at how you can embark on TCFD reporting.